Where does the capital flow in AI&ML? An overview of sectors, investors and opportunities

Overview of capital flow in AI & ML

It’s December, time to take stock. This year, the AI and machine learning industry has exploded and attracted more and more attention. Numbers are the most obvious growth indicators, let’s speak about it.

Over the last twelve months, the inflow of private capital into the AI & ML (venture capital, angels, individuals, and corporations) amounted to $67.63 billion versus $30.57 billion a year earlier, making +121.23% year-on-year. The average funding round totaled $3.44 million over the past 12 months versus $1.61 million last year, yielding a 113.66% YoY increase and supporting several trends within the domain.

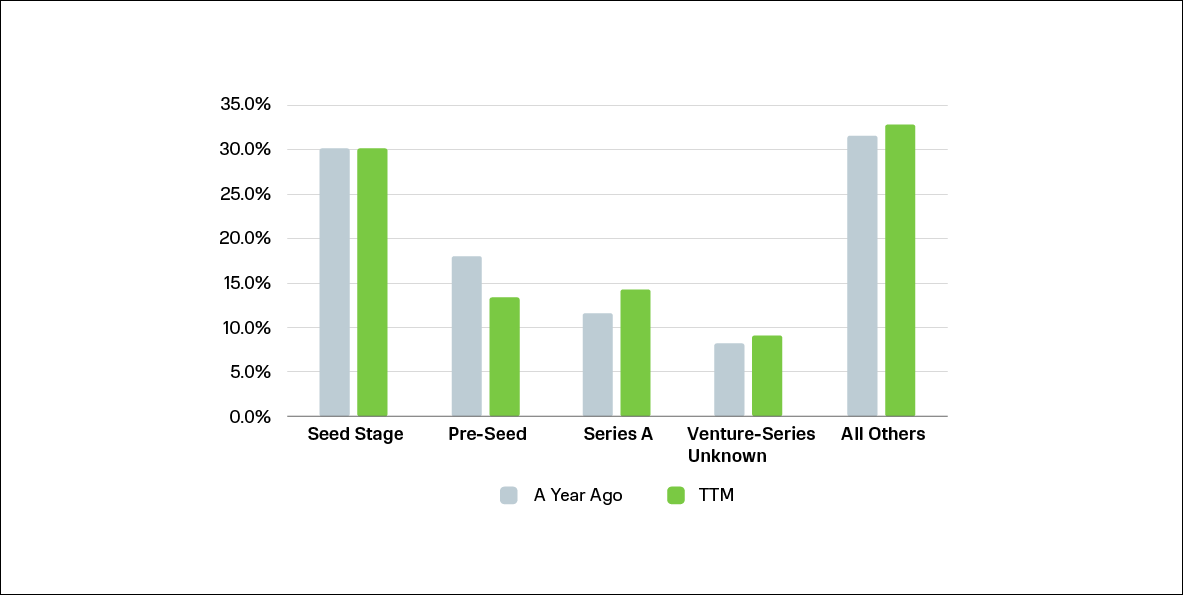

Funding remains tightly centered around early-stage rounds, as seed stages raised 30.1% of total capital (based on last-twelve-month data), compared to 30.2% a year before. It should be noted, however, that pre-seed funding has dropped significantly from 18.1% last year to 13.4% in the last twelve months.

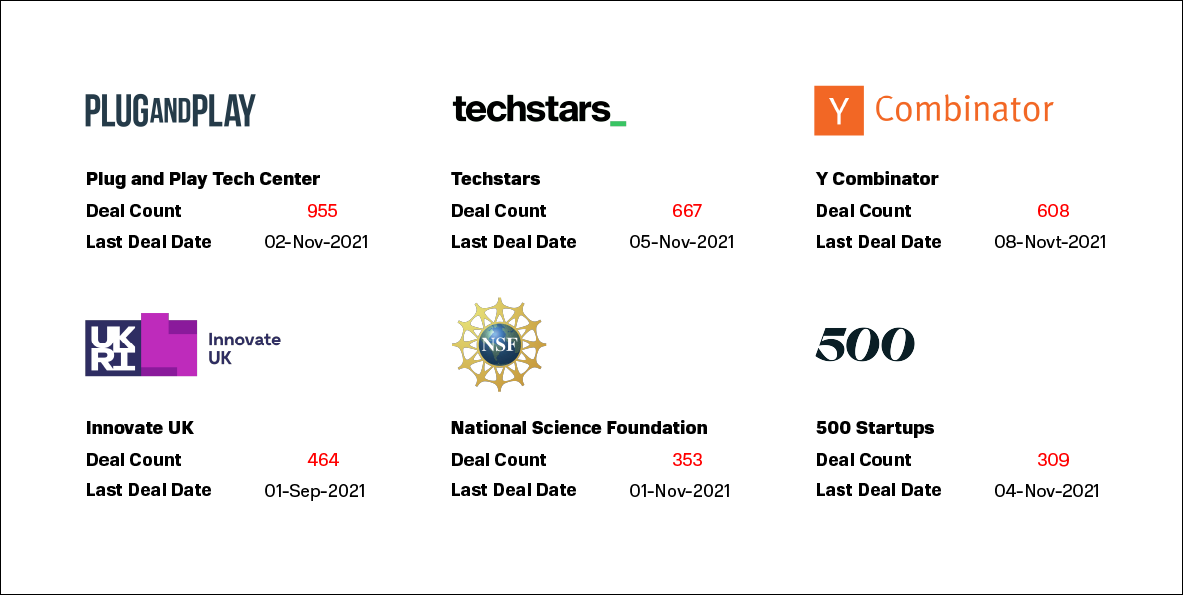

This suggests that the AI & ML field is starting to show early signs of maturity. In addition, we must say that funding for Series A companies in total investment increased from 11.7% a year ago to 14.4% in the last 12 months. The number of contracts made in the AI & ML domain in 2021 was 3,971, which is 10.7% less than last year, with 4,447 contracts. During the same period, the number of investors involved in these contracts was 5,535, with approximately 1,156 investors being individuals or angels. The most active investors over the last twelve months were Plug and Play Tech Center (955 contracts), Techstart (667 contracts) and Y Combinator (608 contracts).

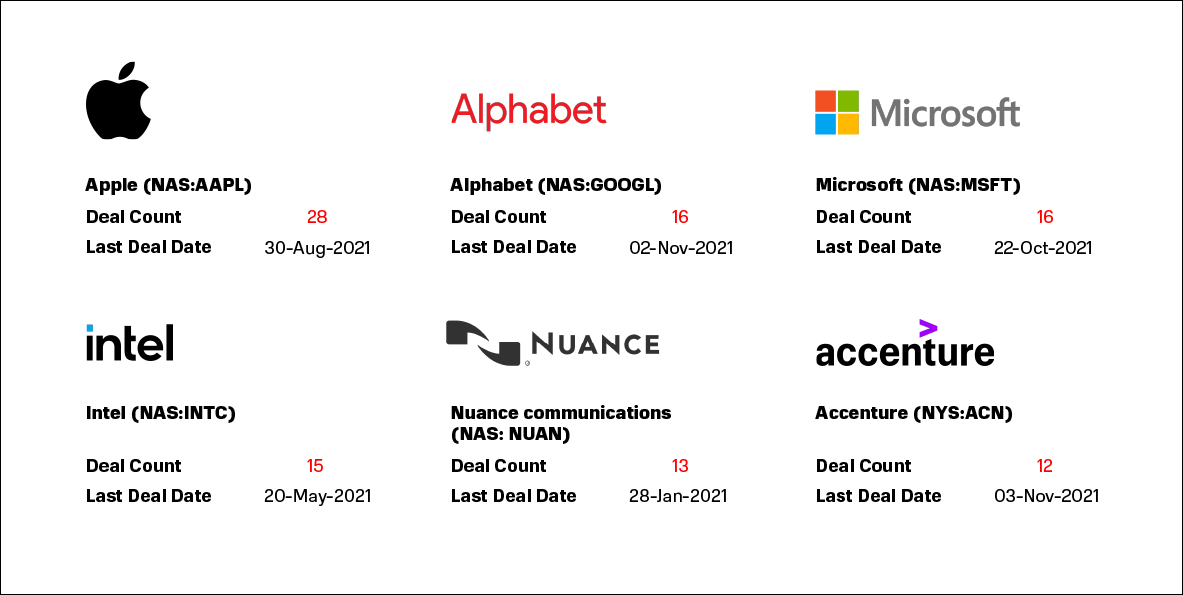

Tech giants continue to expand their AI & ML presence through acquisitions. This year has seen 426 mergers and acquisitions in the artificial intelligence sector, which is 77.5% more than last year. This trend demonstrates that tech giants are showing more interest in AI and that acquiring the intellectual property of certain startups is more attractive to them than in-house developments. Among the most active buyers in the AI & ML domain were Apple (28 contracts), Alphabet (Google’s parent company, 16 contracts) and Microsoft (16 contracts).

With the global economy facing uncertainty, stock markets are extremely hot, and the trend of business digitalization continuing to unwind, we expect venture capital activity in terms of investments in the AI domain to remain high in the near future, while estimated values may begin to decline, which will limit the options of venture capitalists for the exit.

Notably, the average post-investment valuation of AI & ML startups over the past year has grown by more than 112% and currently stands at $39.73 million amid the heated stock markets and, therefore, the market performance of public companies.

After 2020, the world literally started going against the stream: trends have changed, the time has accelerated, and a new era has come – the era of AI. The 2021 figures clearly confirm the rapid growth of both individual segments of AI and the industry in general.

So, what are we going to see next year? Will the predictions come true? What will be the hottest trends? Time will tell, and we will share the latest news with you.